what to do the year before you buy a house

This post is sponsored by Lexington Law.

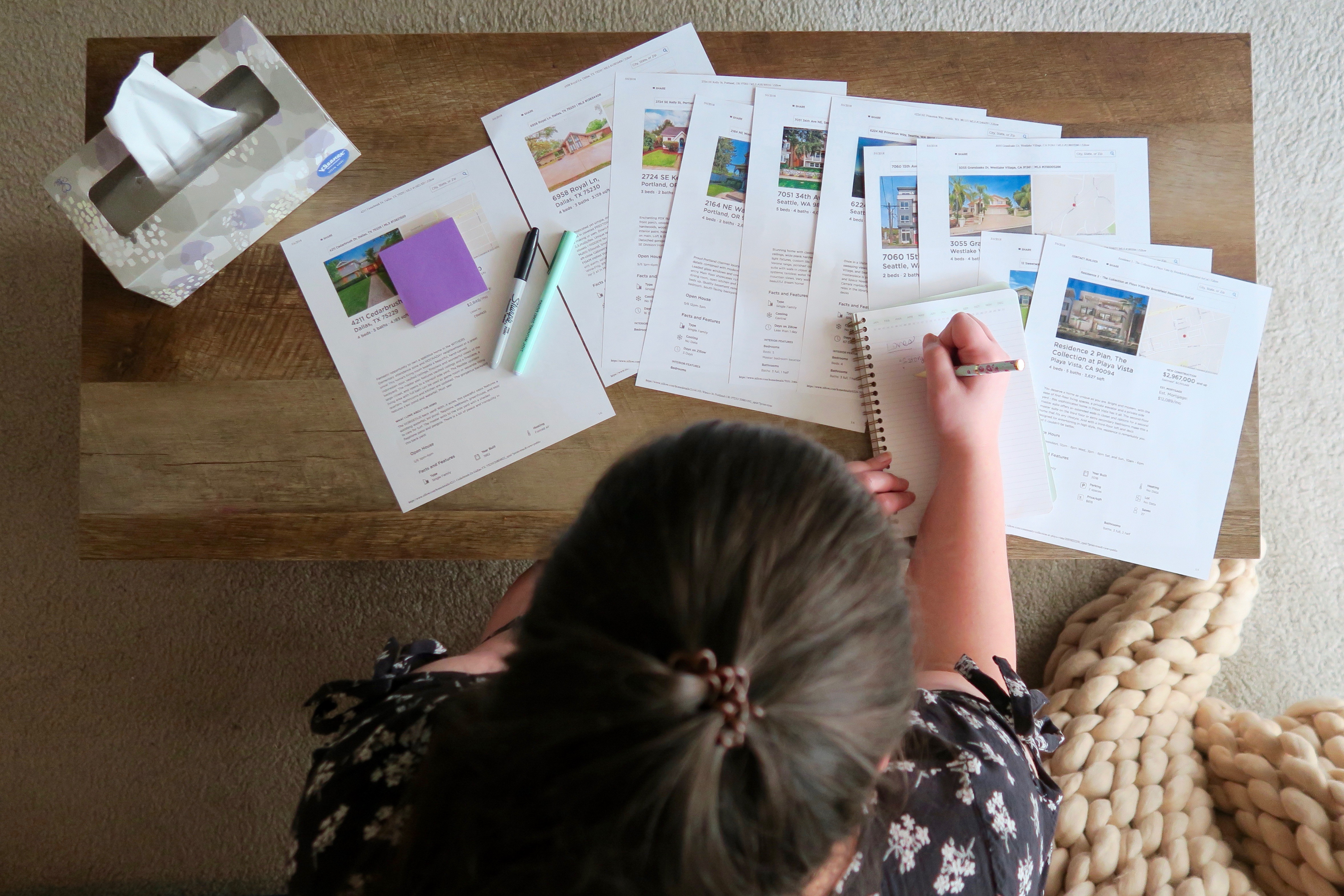

Buying a domicile is an exciting prospect. Whether you lot're buying information technology for you and your family to live in or as an investment holding, at that place are some things you'll desire to start thinking about the things to exercise the year before you purchase a house.

Preparing to buy a home is similar getting ready for a job interview — you want to be every bit ready as possible and then you lot do your research, polish your resume, iron your clothes, and go in with confidence. If buying a dwelling house in the next year or so is something you lot plan to do, here are 10 things you should be considering 12 months out.

ten Things To Do The Yr Before Yous Buy a House

one. Effigy out what you lot tin afford.

Before you get into floor and paint colors, calculating what you can *actually* afford to purchase based on your current accept-home income (not gross income) is a good place to start.

The xxx% Rule used to exist somewhat of a standard when it comes to landing on a number. But many financial experts and financially-savvy individuals are finding that to exist outdated in today'due south economic system.

I'thou quite addicted of the 28/36 Qualifying Ratio every bit explained by Miranda Marquit at Lexington Law. She says,

"According to Re/Max, many lenders use the 28/36 rule to effigy out whether your finances can handle your home purchase. The 28 refers to the pct of your gross monthly income that should exist spent on your monthly housing toll. The 36 refers to the percentage of income that goes toward all your debt payments, including your mortgage."

I personally think to be on the realistic side of things — that is to say the side of the money actually landing in your bank account every month — that y'all should use your take-habitation pay number, not gross income.

Say for example your take-home pay is $4,000. 28% of that leaves yous with $1,120 to spend on a mortgage. 36% of that is $one,440. Using the 28/36 Qualifying Ratio, that leaves you lot with $320 to spend on all boosted debt yous may have. Given student loans, car loans, and other consumer debt, it'due south now up to you to look at your debts and see if this is realistic. Say you have $500 in remaining debt (for instance, your car loan), that additional $180 is going to have to come from somewhere in your budget. In the chance information technology can't, realistically the mortgage you tin can afford on your income is $940.

If you lot were to utilise the thirty% Dominion, you lot could end upwards paying $i,200 on your mortgage, which may or may not be realistic looking at your upkeep.

Ultimately, a lender will only corroborate so much and at that place are other factors to consider every bit well like your involvement rate, down payment, and length of mortgage. Don't let anyone button you to buy something that is going to strain you financially. That money comes out of your wallet, not theirs. A house or property is not an investment if information technology drains your bank account.

[clickToTweet tweet="A firm or holding is non an investment if it drains your bank business relationship." quote="A house or property is not an investment if it drains your banking company business relationship."]

2. Check all of your credit reports.

Creditors aren't legally required to study your credit history to any, allow alone all three, of the major credit bureaus. This ways there can exist differences between your credit reports that you might not be aware of. This gets tricky because there also isn't any requirement for potential creditors to look at any or all of your reports.

My senior year of high schoolhouse, right before I was going to college and taking out student loans for freshman yr, I checked my credit report for the first time. I was certain there wasn't going to be anything there because I'd never had a credit carte or car loan, but lo and behold, I discovered something unsavory.

My mom and I ended upward discovering that I had been a victim of identity theft and someone had been using my social security number to work at a grocery shop. Clearing it up required filing a law report and a lot of phone calls, but it taught me the importance of monitoring your credit. Unless you accept someone to advocate on your behalf and navigate the tricky situations, information technology's really up to you to remain diligent. That situation is why I employ a credit monitoring service, like Lexington Law'southward OnTrack Tool, to monitor my identity on a daily ground. Equally I get older, the financial stakes are college and it's of import to me to protect myself.

If you're already aptly monitoring your credit, way to go! And if not, I'd recommend looking into an credit and identity monitoring tool to bank check your FICO score, accept your credit monitored, and to actively piece of work towards improving your credit score and financial future.

If you come across incorrect or unfair items on your credit report, Lexington Constabulary will abet on your behalf to claiming any unfair, inaccurate or unsubstantiated item listed on your credit report which can help increase your credit score. They work for you, not a credit bureau or a creditor and have your best interest at heart.

[clickToTweet tweet="Things To Do The Year Earlier You Purchase a Firm" quote="Things To Practice The Twelvemonth Before Yous Buy a House"]

3. Get your credit score up.

As we've covered before, there are many factors that make upward your credit score. Your credit score is so important to lenders (who volition potentially be loaning yous hundreds of thousands of dollars) because it'south a measure of your credit trustworthiness. The lower your score, the less they trust you to pay them dorsum.

Having a lower credit score is actually beneficial to them. That ways that you are going to exist paying them back more than money in involvement over time. At the same time, they are also taking on more take a chance by lending you money (that if yous can't pay back it dorsum, means they'll have to repossess your property). Having a good credit score is however beneficial to the lender (they are getting paid back and making interest, afterwards all), but the real divergence here is how it affects your ain personal finances.

A higher credit score means a lower interest rate which means you'll be paying less over time to borrow the money you need to buy your home. A few points can make a massive difference, so do everything you can to increase your score.

4. Avoid opening any new lines of credit.

Opening new lines of credit are going to put hard inquiries on your study. This tin potentially bring your credit score downwards. If you're hoping to utilize a new line of credit as a way to amend your credit score, begin thinking nigh this in the range of x-18 months out of your ideal buying time. New lines of credit require hard inquiries on your credit report which can ding your score.

5. Don't miss whatever payments.

Your payment history makes upward a whopping 35% of your credit score. Even one missed payment can be potentially devastating, let solitary multiple missed payments.

As an example, I accept a friend who missed several student loan payments due to a miscommunication while he was deployed. These missed payments dropped his credit score past over 200 points. It'south painful to even call back about.

half-dozen. Practice living with your new mortgage.

Ahead of time, it's probably worth information technology to go a pre-qualification (non a pre-approval) to get an overview of where you stand up with a lender. Compare lenders and pick a few and shop smart. Do your inquiry on which lenders are most likely to give y'all the best rates based on your income, downward payment, and credit score.

Once you lot've been pre-qualified and sympathise what you can afford practise living that way. If it's less than your current rent, that'southward peachy! You lot'll know you lot won't have a problem affording it. Just if it's more, become used to budgeting with a higher housing payment every month. Check in with your budget to get an overall feel for your new reality.

7. Save, save, save!

Bated from the downwards payment, ownership a dwelling can as well come up with extensive costs. From the down payment to contained appraisals to necessary updates to your closing costs, buying a dwelling can be far more than expensive than one might expect. Also remember that if you're purchasing an investment holding, mortgage insurance won't comprehend it then upfront costs are generally higher.

Talk to your habitation-owning friends and come across what surprised them the about near buying a abode. One of my friends shared that she and her married man planned to put downward $100k. Subsequently closing costs and fees, their downward payment was closer to $80k. She and her husband are financially savvy and plan to pay their mortgage off early on, and even still it defenseless her off guard.

If you're buying an investment property, you might desire to make upgrades and repairs before renting information technology out which can cost you valuable months of hire plus the price of those repairs. Having cash you can apply for this purpose versus taking out a loan tin can make a huge difference in your standard of living.

8. Scope out the areas you're interested in at all times of the solar day.

The vibe of a neighborhood tin can exist completely unlike from a weekday afternoon to a Saturday night. If y'all have a specific surface area you lot're looking in, drive through at all times of the mean solar day to go a feel for information technology. How do the neighbors deed? Are there kids outside? Does the area experience dangerous? Is in that location an HOA? Do people take intendance of their homes? Check local crime reports and look into neighborhood sentry updates. Which grocery stores would you become to? What well-nigh schools? What conveniences are nearby? Don't just focus on the home you're potentially buying but also the must-haves and nice-to-haves for your area likewise.

9. Think long-term.

Check the market place and values of nearby homes. Take into account your goals for buying a dwelling. Are y'all planning to sell in a few years or live here for potentially a decade? The neighborhood, and not just your home, brand a difference when it comes time to sell.

On a like note, the home ownership procedure also involves a lot of negotiation. It's important to recollect that not anybody is always on your side. Not that anyone would intentionally attempt to deceive y'all per say, but information technology's a good idea to also get additional and independent decisions, inspections, and quotes before signing on any dotted line.

Likewise consider how owning a home volition impact your life years down the line. You might be thinking that paying a higher mortgage is worthwhile. Just what nearly when you have other expenses similar children, instruction, or illness? Consider how you'll feel and what your life looks like in 5-10 years down the line.

ten. Don't rush.

Every bit it turns out, things don't always go according to programme. It might take you lot longer than a year to notice your perfect location, become your credit upwardly, and go to endmost for a home. Don't let yourself rush into buying a home that's not truly right for you lot.

There are a ton of factors that you'll want to consider for yourself. Many times nosotros hear things on social media about how people bought a house seemingly spontaneously. While we tin can be happy for them, that doesn't necessarily mean they've made a good decision. At the end of the day, you're the 1 who will be living in and paying for the home you buy.

A home is a big purchase and is an heady prospect. Before signing whatever documents, though, be prepared going into your search with research and flexibility. If you're finances aren't however in order, do what you can to start improving them today. Consider working with a company who will advocate on your behalf, similar Lexington Constabulary. They volition work with you to meet your goals and amend your financial standing for a brighter futurity. So if you're thinking virtually buying a house in the adjacent year, congratulations! We're thrilled for y'all.

Most the Writer

caldwellbastoofter.blogspot.com

Source: https://gentwenty.com/things-to-do-the-year-before-you-buy-a-house/

0 Response to "what to do the year before you buy a house"

Post a Comment